MIST x Orion Pool: Orion Protocol’s AMM Solution

We are very excited for this next step! Big thank you to the Orion team for all the help behind the scenes.

Read all the details here: https://blog.orionprotocol.io/mist

MIST to ‘self-list’ on Orion Pool: Orion’s AMM Solution

Recently, Orion announced its upcoming AMM solution: Orion Pool. Alongside the four starting pools, third party projects will be able to self-list their token on Orion Pool paired with ORN, enabling greater accessibility to assets on Orion Terminal. MIST will be the second project to join Orion Pool and provide liquidity for the MIST pool, with more to come.

Leading up to Main Net Staking, Orion is combining both existing forms of pre-staking into Main Net Pre-Staking. ORN token holders will be able enjoy staking rewards, governance, and added utility directly from the Terminal, without losing custody of their ORN. This liquidity will create Orion Pool: Orion’s AMM solution integrated directly into the current swap interface to create a seamless experience for the end user. As usual, Orion will route all swap orders to the liquidity source with the best price possible price.

Initially, Orion Pool will launch with four ORN pools including ORN/ETH, ORN/USDT, ORN/BTC, and ORN/BNB, but third party projects will be able to self list their token on Orion Pool paired with ORN. This will enable liquidity for new assets and pairs to be added to the terminal — increasing assets and pairs exponentially.

Mist will be the second project to join Orion Pool and provide liquidity for the MIST pool.

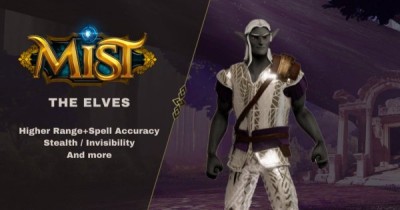

Based on BSC, Mist is a blockchain-based action RPG game revolving around NFTs, Staking and Farming. Mist uses farming and staking both inside and outside of the RPG game to make use of the MIST token. Whereas regular NFT tokens often parade as collectibles, Mist’s NFTs are functional. Each one inserts directly into the Mist Game Framework, making them special in-game items when playing.

How will the pool work?

Liquidity Providers on the Terminal will receive Liquidity Mining rewards spread between the multiple ORN pools. Alongside liquidity providers, we will be adding Governance Stakers to our Main Net Pre-Staking to ‘vote’ on the pool to receive rewards.

- Initially, Orion Pool will launch four ORN pools: ORN/ETH, ORN/USDT, ORN/BTC, and ORN/BNB. Soon after, this will include an FTM pool and MIST pool.

- Orion Pool will be compatible with ETH and BSC, allowing flexible and profitable participation in the liquidity pool for LPs and traders alike.

- Orion Pool’s interface will be fully integrated into the Terminal. This allows LPs and traders to benefit from a single UI for swapping, adding/removing liquidity, staking, and governance voting.

- Orion Pool fees will be 0.3%, with ⅔ going towards LPs, and ⅓ going towards ORN Governance Stakers.

- The interface will also include a dashboard for LPs to add/remove liquidity, along with ORN Governance Stakers to vote for specific pools and future assets on the Terminal.

Liquidity Providers: As per typical liquidity mining programs, Liquidity Providers will provide 50:50 ORN and the matched asset. Liquidity providers for Orion Pool will benefit from multiple sources of income: swap fees from the AMM pool, farming rewards via Orion’s Liquidity Mining program, and ORN staking rewards generated from all of Orion’s products. Liquidity Mining rewards will be spread between the multiple ORN pools.

Governance Stakers: ORN Governance Stakers will be able to vote towards a specific ORN pool. Liquidity Mining rewards will be spread between each pool according to the amount of votes they have. This allows ORN holders to dictate the rate of rewards each pool will receive. ORN Governance Stakers will receive ⅓ of all the swap fee revenue that Orion Pool generates, in addition to the regular staking rewards that are allocated to Governance Stakers. In addition to voting for Liquidity Mining reward share, ORN Governance Stakers will also be able to use their staked ORN to vote for future assets on Orion Terminal.

What is Orion Protocol?

ONE TOKEN. ONE PROTOCOL. 18 REVENUE STREAMS.

Orion Protocol is building the decentralized gateway to the digital asset market. The layer 2 solution enables users access to deep, cross-chain liquidity in one place — across DEXs, CEXs, and swap pools — providing access to the best price in the market without the need to ever give up their assets. Orion seeks to solve the fragmentation of crypto markets, NFTs marketplaces, and assets from traditional finance by eventually aggregating them into one place: Orion Terminal.

Orion is building over a dozen solutions for blockchains, exchanges, and crypto projects, resulting in over eighteen revenue streams on the protocol. The Orion ecosystem has been built with ORN holders in mind: every transaction across the multiple solutions on the protocol adds to Daily Protocol Volume, bringing lucrative rewards for stakers.